Our Services

Finance x Administrative Reform

Radical Reform for Bank and Insurance Company Back Offices

In order to respond to the acceleration of corporate digitization in recent years,

companies must establish new policies for the structural reform of administrative work

and perform a complete overhaul of in-house operations.

Through the use of proprietary software and hardware, Primagest can implement radical

business reforms by digitizing and automating operations that alter the business model

of the financial industry and improve its profit structure.

Banking

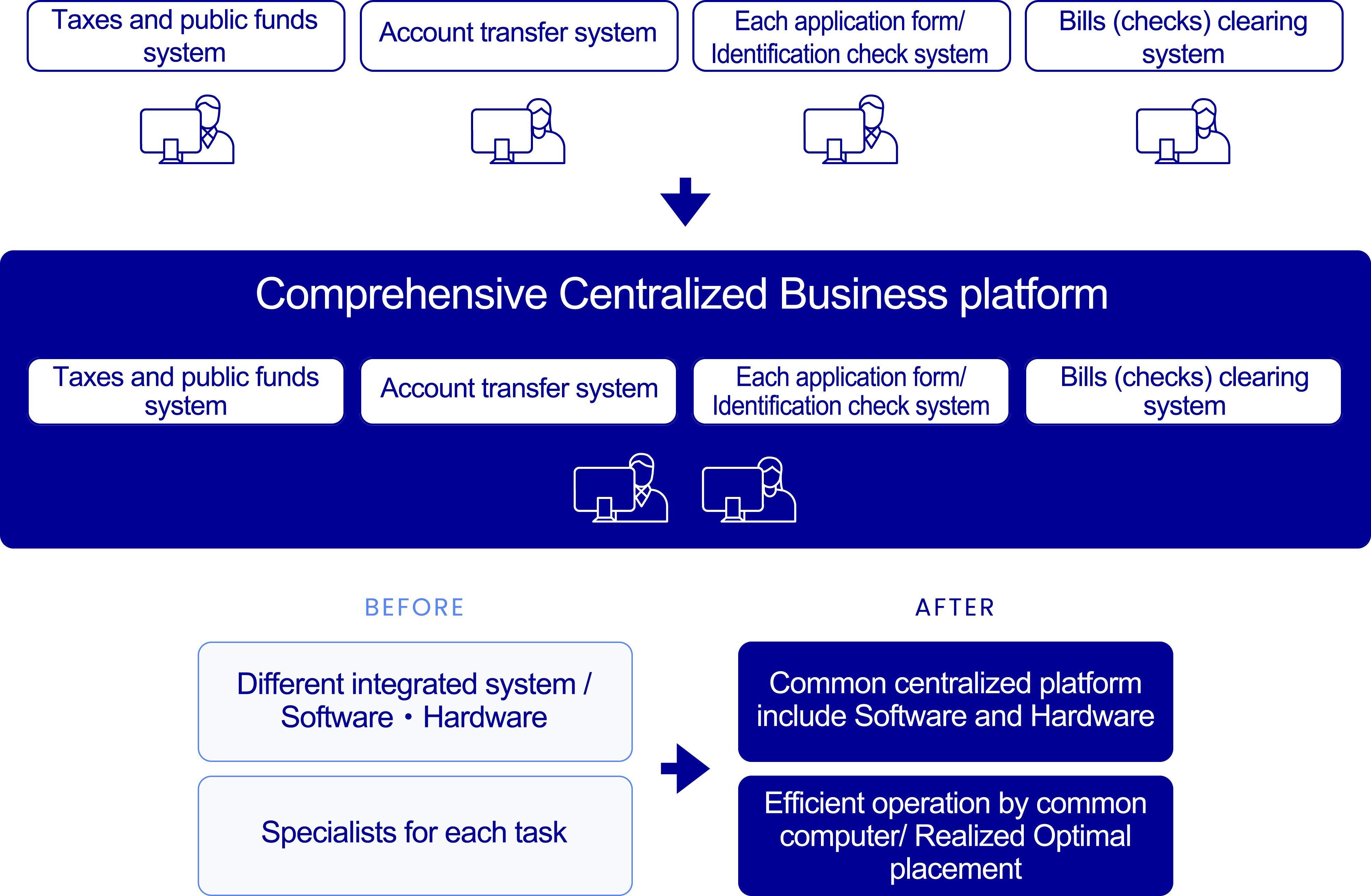

The amount of paper-based processing has decreased with rise of the paperless society, but this has created issues with system optimization and staffing. Primagest provides a common business infrastructure that enables the sharing of joint resources based on intra-process communication carried out with our proprietary high-speed and medium-speed scanners and software based on our unique image processing technology.

- POINT 1

- Shared Software

- POINT 2

- Shared Hardware

- POINT 3

- Shared Personnel System

- POINT 4

- Curbing Individual System Modifications

It starts with software shared through a common system or hardware shared through a common resource terminal. Once companies break away from individual system modifications, they can start implementing shared personnel resource systems for optimal personnel allocation.

Insurance

In the insurance industry, technology is not used to its fullest potential in various

workflows (front-end processing, classification, extraction, and assessment) of back-office

operations, making it difficult to assign personnel to tasks, train personnel, and secure

administrative offices.

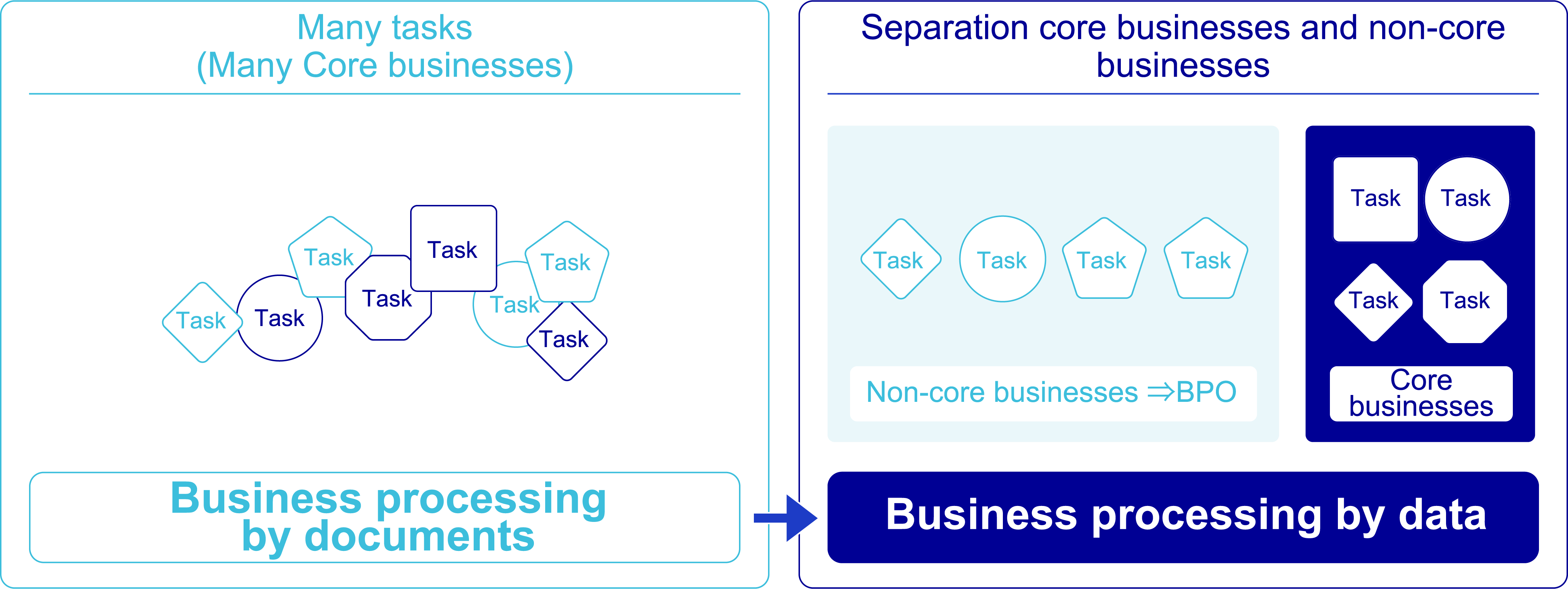

Primagest offers BPO services that utilize OCR and AI technologies for non-core operations

like text extraction from application forms, medical certificates, and other documents,

thereby enabling clients to automate some of their core operations, such as assessment, to

reduce the burden of skill-less tasks on personnel while improving operational efficiency

and reducing costs. Clients can then focus on their core business and deploy the personnel

needed to handle the increase in insurance claims filed each year.

- POINT 1

- Installing a Shared Admin System for Unified Operations

- POINT 2

- Reduce Personnel by Creating

Processing Rules and Simplifying Tasks

- POINT 3

- Regulate Busy Periods by Sorting

Paperwork Processing Tasks

- POINT 4

- Transversal Business is Possible

as No Training is Needed

In this way, we can provide services that drastically reform profit and organizational structures by conducting a thorough review of administrative processes through consulting services that make full use of the system construction and BPO operation know-how we've gained over many years in both the banking and insurance industries.

Related Solutions

- Banking - Tax and Public Money Revenue BPO

- Banking - Centralized Image Workflow Administrative Infrastructure

- Banking - Returned Mail Solution

- Life Insurance - Claims Payment Automation Solutions

- Life Insurance - Outsourcing of BCP-compliant Insurance Operations

- Life Insurance - New Policy Outsourcing 'Intelligent BPO'

- Credit & Consumer Credit - Securities Account Creation and Modification

- Credit & Consumer Credit - Account Classification System

- Credit & Consumer Credit - Credit Card Admission Screening and Credit Limit Monitoring Solutions