SOLUTION

Non-life Insurance

- Payment Solutions

By utilizing the image workflow system,

we support the assessor (adjuster) to ensure that payment is made within the deadline without fail.

- POINT.01

- Prevent payment omissions/missing billing recommendations

- POINT.02

- Thorough due date management with image workflow

- POINT.03

- Realizing business that does not use paper, by making it paperless

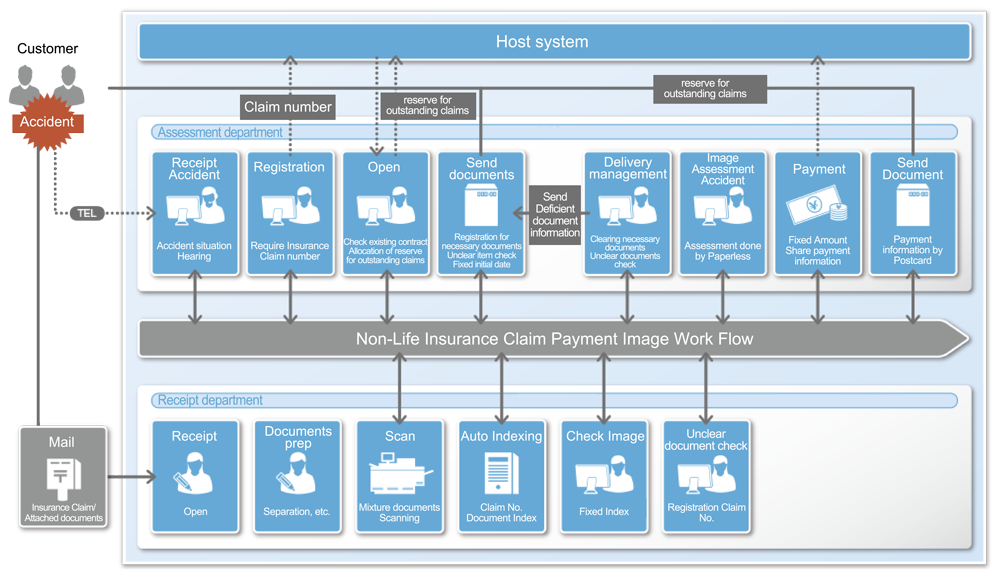

Solution Overview

The non-life insurance industry now offers a wide variety of products to meet customer needs, including automobile, fire, earthquake, personal accident (family, leisure, travel, etc.), and new types of insurance (medical, nursing care, income compensation, etc.). Payment operations require experience and know-how to correctly assess these complex products without omission of payment and to make payment within the deadline (within 30 days).

Primagest's Non-Life Insurance Payment Image Workflow System (Image Workflow) is a system that supports adjusters in making payments on time and without omissions by utilizing image solutions.

We solve these challenges

- Before

- Payment omission / billing recommendation omissions occurred

- After

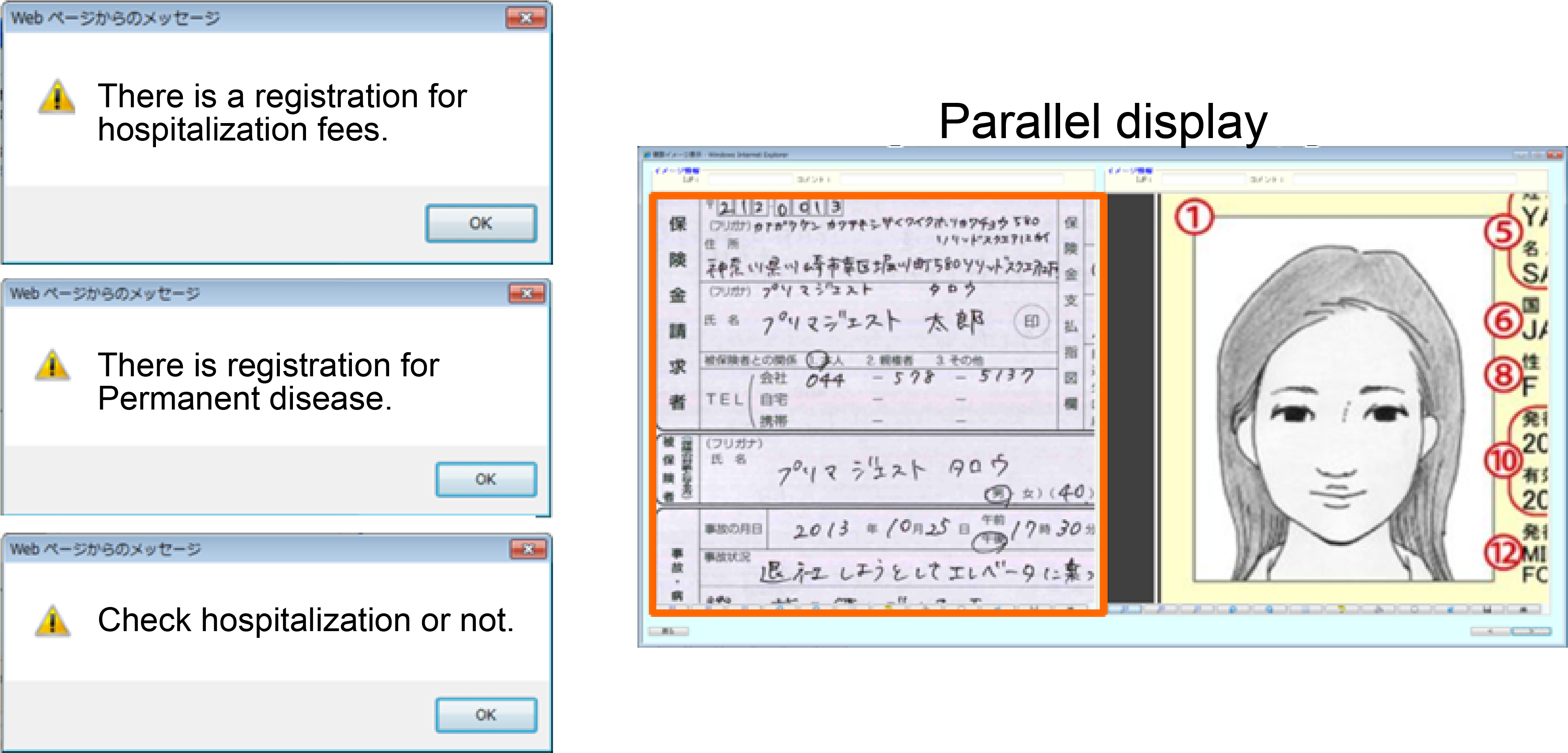

- Prevention function of payment omission / billing recommendation omission in image workflow

(warning alert)

- Before

- Mainly paper work,

difficult to manage due dates

(payment delays occur)

- After

- Thorough due date management with image workflow

- Before

- Paper-centered business risking loss of or damage to personal information documents

- After

- Paperless business structure realized dispensing with paper

Solution Details

Image Workflow Features

01

・To ensure payment, alerts are displayed for each system product to warn of missing billing recommendations and payment omissions.

・Various image display functions to make it easier for assessors to assess even a change is made from paper-based to paperless operations.

After Introduction