SOLUTION

Municipalities

- Tax Processing Systems

Achieve significant operational efficiency in the administration of municipal tax assessments in local governments.

- POINT.01

- Centralized management of taxation documents

- POINT.02

- Support for prompt and accurate tax data preparation

- POINT.03

- Business navigation by system

Solution Overview

In recent years, municipal tax levy administration has reportedly faced a variety of problems.

① Rapid spread of electronic tax returns while local governments are not ready to accept them

② Increased administrative complexity due to the use of various forms of taxation data, including paper and electronic data

③ Decline in quality due to lower outsourced entry fees

④ Work to respond to the annual revision of the taxation system

⑤ The aftermath of the increasingly imminent reduction in the number of employees in the Municipal Tax Section

⑥ Transfer of staff with expertise due to personnel changes

In response, Primagest has developed a Taxation Operation Support System that solves the problems of municipal taxation and will be introduced in multiple municipalities to realize a significant improvement in the efficiency of municipal taxation operations.

We solve these challenges

- Before

- Complicated operations due to rapid spread of e-filing

- After

- Improvement of efficiency by centralized management of all taxation documents, regardless of whether they are on paper or e-filed

- Before

- Mistakes in taxation data and poor quality of punch data

- After

- Support for quick and accurate creation of tax data by using the rule management function and OCR function

- Before

- Tightening of the workforce due to personnel changes and reductions in staff

- After

- Automatic visual navigation by the system of what to do next so that even staff without know-how can use the system

Solution Details

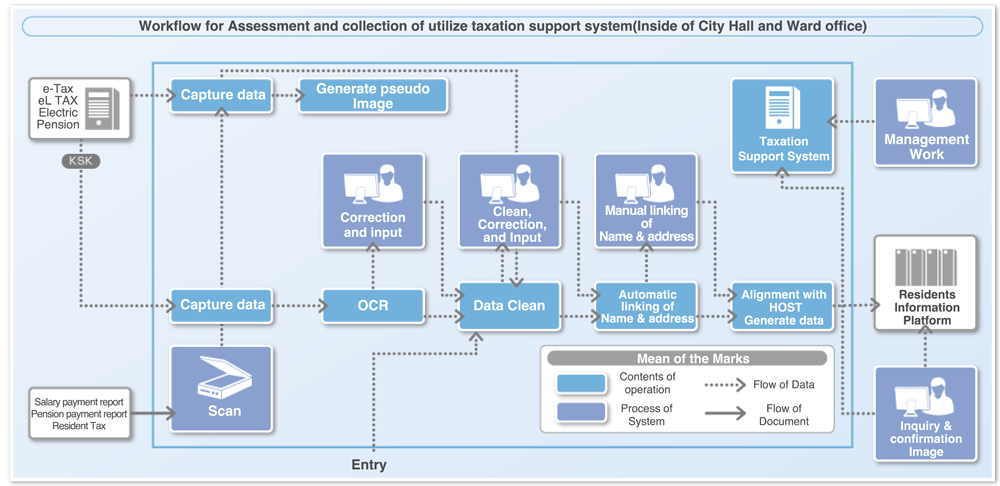

Overall Overview of Taxation Business Support System

01

・By combining multiple functional groups (components) that are programmed according to the business unit required, a system is quickly and accurately constructed to meet customer needs.

・The Rule Management System Function (BRMS) automatically detects tax data errors by checking tax laws, and the OCR Entry Function enables rapid data conversion.

・Realizes centralized management of all taxation documents such as payroll reports and tax returns.

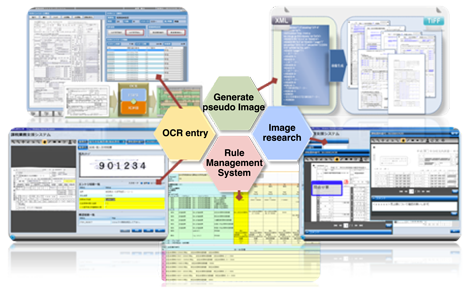

Overview of National Tax Linkage Processing Functions

02

・After importing the KSK from the examination terminal, the OCR of Table 2 is automatically processed, and post-OCR corrections can be made by navigating the screen.

・The data from Tables 1 through 5 can be automatically checked for tax errors, and corrections can be made by following the on-screen navigation. (Rules Engine)

After Introduction

Feature Functions

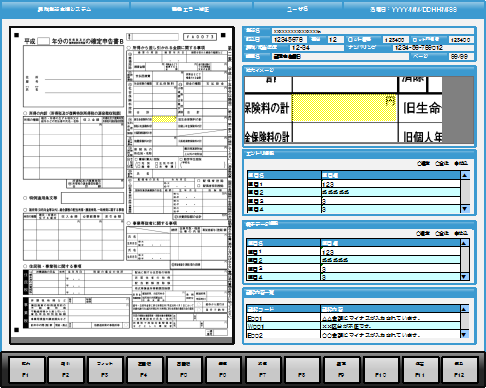

①Function to link with tax systems

②Image reference function from each terminal

③Function to clean up all tax data

④Forwarding to other municipalities, automatic data output, etc.

⑤Assignment of functions by authority

Effects of introduction

①Improved efficiency in tax assessment and inquiry operations through image inquiry from viewing of paper tax slips

②Warehouse storage of original paper forms becomes possible through imaging, which expands the space available in the office

③Cleaning of taxation data by rule check

④Improvement of operational efficiency and reduction of costs by dividing the error processing between staff and temporary staff

⑤Elimination of the risk of loss and processing errors through imaging and progress check functions